A homes outdoor space can be just as important as the indoor living space. In fact, there are scientific

backed reasons that a homeowner’s outdoor space makes them happy.

Several of these include, it is a space for bonding, plants can reduce

stress and give off oxygen to help you breathe deeply, it can make you

feel younger and it can prevent depression.

Builder’s see the importance in this concept when building most homes. According to the NAHB (National Association of Home Builders) out of the new homes

started in 2017, 58.6 percent included patios. This is a huge jump from

2011 where under 50 percent of new homes had patios. The SOC (Survey of Construction) also points out that patios were more common than decks by 23.8 percent in 2017.

Patios differ in size and materials throughout the United States. The

average size of a patio on a new home built in 2017 was 260 square feet

according to the Annual Builder Practices Survey

(BPS)

conducted this year. Although patios are not as common in New

England and Middle Atlantic, surprisingly when it comes to new homes

with patios, they are the largest nationally topping off at over 370

square feet on average. The building materials used in the two regions

usual consists of poured concrete with concrete pavers, natural stone or

brick pavers. In the West South-Central poured concrete is not used as

much as just concrete pavers.

Over the nine Census divisions there are vast differences on the

amount of new homes that were built with patios in 2017. On the high end

were the West South-Central at 80 percent, the Mountain at 71 percent,

the Pacific at 62 percent and the South Atlantic at 62 percent. The

division under 50 percent include West North-Central, East

North-Central, New England, Middle Atlanta and East South-Central.

The Northshore is definitely a perfect area for a patio and will make

a great space for homeowners to relax and spend weekends and evenings

in the great outdoors.

Click Here for source of the information.

We're a Local St. Tammany Parish New Home Builder. This blog will share information about the real estate industry in the Greater New Orleans area and the Northshore of Lake Pontchartrain in particular. Stay tuned for local and industry news regarding new homes!

Showing posts with label building a new home. Show all posts

Showing posts with label building a new home. Show all posts

Wednesday, October 17, 2018

Patios Make A Great Outdoor Living Space

Friday, April 22, 2016

Reasons to Stay in Your New Home 5 Years

Whether you are buying your first home or your 4th home, the time you

spend in your home before downsizing or upgrading makes a financial

difference in your investment. Most people start out in the real estate

industry when they buy their first home. Unless they come from a very

wealthy family or have won the lottery, the home is priced modestly or

on the low end and is built that way as well – smaller square footage,

less bedrooms and baths, in an up and coming neighborhood. First time

home buyers can be single professionals who are successful, in a steady job, with an income that is rising each year, but most people who buy a home for the first time are couples looking to start a family. These couples eventually would like to move out and move up to provide more space for their growing family. They are “getting their foot in the door” with their first home to establish credit and create equity opportunity to eventually sell and move up to something bigger.

The biggest question then, to ask is this – how long do you stay in your home in order to make sure you aren’t losing money and to build enough equity to become a “move-up buyer?” The answer to this depends, but it is typically about 5 years. Below are the reasons for this number:

1. Closing Costs: Whether you are buying a new or previously owned home (resale) or refinancing your home, you are going to “run into” closing costs. Closing costs is the profit for loan originators, title companies, and the state in which you live (recording fees) which are charged during the loan process. Every company needs to make money, and closing costs are how they make theirs. Closing costs are, most of the time, added to the principle of your home, increasing your loan amount and shrinking your home’s equity. Each time you make a real estate transaction, you are charged these costs. Staying in your home approximately 5 years “pays off” these closing costs enough for there to be enough equity in your home (most of the time) to have money for a down payment when you move to your next “move-up” home.

2. Interest: Even with the historically low interest rates in the market today, the mantra in real estate still stands, “The Bank Gets Paid First.” When you are paying your monthly loan payments, you will notice on your mortgage statement that the amount of principle being paid on your home is significantly less than the amount of interest being paid. You can also see this on your amortization schedule during your closing. As your loan “ages,” the amount of interest balances the amount of principle and eventually ends up being less than the amount of principle during the last years of your loan. If you only stay in your newly purchased home for a short period of time – say 3 years – the amount of principle you “pay off” will not be enough to merit a sale and move unless you are making extra principle payments each month. The recommended period of time to stay in your home, reduce the amount of interest charged, and pay off as much principle as you can in order to gain equity during a sale is 5 years.

3. New Vs. Used: The type of home you buy can also make a difference in how much time you spend in it before you upgrade to something bigger and better. If you are buying a new home, it really doesn’t make that big of a financial difference in the time you spend in the home because typically, in a new house, you don’t end up with much maintenance on the home until about 4 – 5 years in. On a previously-owned home, resale home purchase, however, there may be a significant amount of upgrade and upkeep that you will expend when you first move into the home. Depending on the age of the home and the last time it was renovated, big system items, such as hot water heaters, condensers, garbage disposals, ductwork, roofing, etc. could end up needing to be repaired or replaced. If you look at the amount of money you spent on renovating the home, the amount of interest you pay on your monthly mortgage payment, and the amount of closing costs you paid during the initial purchase; you may see that it would behoove you to stay in the house for about 5 years (or more) to get the equity out of the home to pay off your financial investment.

4. Appreciation: The “golden days” of “instant appreciation” are fewer and farther in between when it comes to purchasing your first home in an “up and coming” area. During the real estate boom of the early 2000’s, subdivisions were seeing appreciation in their homes from the beginning and build out of Phase I to the commencement of building Phase II. You have probably seen the prices on the signs change from Phase I to Phase II where the exact same floorplan started selling $10,000 – $20,000 higher in Phase II than it did in Phase I. Those days of instant appreciation are very rare, so when you purchase your home in an area you expect to experience residential and commercial growth, you, as a homeowner, may have to wait a little bit longer for that long-anticipated

appreciation to come about. Along with the other factors mentioned above, this is yet another reason to wait approximately 5 years before selling and moving to a bigger and better home.

Ron Lee Homes, a home builder in St. Tammany Parish, specializes in 2nd home (and above) move-up homes. Whether you are looking to build a semi-custom or fully custom new home in Mandeville, Covington, Madisonville, or Abita Springs, Ron Lee Homes will work with you and provide base floorplan designs for your consideration. Buying or building a new home can seem a little challenging, but working with the team at Ron Lee Homes will make your home buying / building experience a pleasant and satisfactory process. To get started with the plans for the home of your dreams today, Contact Ron Lee Homes at 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

home buyers can be single professionals who are successful, in a steady job, with an income that is rising each year, but most people who buy a home for the first time are couples looking to start a family. These couples eventually would like to move out and move up to provide more space for their growing family. They are “getting their foot in the door” with their first home to establish credit and create equity opportunity to eventually sell and move up to something bigger.

The biggest question then, to ask is this – how long do you stay in your home in order to make sure you aren’t losing money and to build enough equity to become a “move-up buyer?” The answer to this depends, but it is typically about 5 years. Below are the reasons for this number:

1. Closing Costs: Whether you are buying a new or previously owned home (resale) or refinancing your home, you are going to “run into” closing costs. Closing costs is the profit for loan originators, title companies, and the state in which you live (recording fees) which are charged during the loan process. Every company needs to make money, and closing costs are how they make theirs. Closing costs are, most of the time, added to the principle of your home, increasing your loan amount and shrinking your home’s equity. Each time you make a real estate transaction, you are charged these costs. Staying in your home approximately 5 years “pays off” these closing costs enough for there to be enough equity in your home (most of the time) to have money for a down payment when you move to your next “move-up” home.

2. Interest: Even with the historically low interest rates in the market today, the mantra in real estate still stands, “The Bank Gets Paid First.” When you are paying your monthly loan payments, you will notice on your mortgage statement that the amount of principle being paid on your home is significantly less than the amount of interest being paid. You can also see this on your amortization schedule during your closing. As your loan “ages,” the amount of interest balances the amount of principle and eventually ends up being less than the amount of principle during the last years of your loan. If you only stay in your newly purchased home for a short period of time – say 3 years – the amount of principle you “pay off” will not be enough to merit a sale and move unless you are making extra principle payments each month. The recommended period of time to stay in your home, reduce the amount of interest charged, and pay off as much principle as you can in order to gain equity during a sale is 5 years.

3. New Vs. Used: The type of home you buy can also make a difference in how much time you spend in it before you upgrade to something bigger and better. If you are buying a new home, it really doesn’t make that big of a financial difference in the time you spend in the home because typically, in a new house, you don’t end up with much maintenance on the home until about 4 – 5 years in. On a previously-owned home, resale home purchase, however, there may be a significant amount of upgrade and upkeep that you will expend when you first move into the home. Depending on the age of the home and the last time it was renovated, big system items, such as hot water heaters, condensers, garbage disposals, ductwork, roofing, etc. could end up needing to be repaired or replaced. If you look at the amount of money you spent on renovating the home, the amount of interest you pay on your monthly mortgage payment, and the amount of closing costs you paid during the initial purchase; you may see that it would behoove you to stay in the house for about 5 years (or more) to get the equity out of the home to pay off your financial investment.

4. Appreciation: The “golden days” of “instant appreciation” are fewer and farther in between when it comes to purchasing your first home in an “up and coming” area. During the real estate boom of the early 2000’s, subdivisions were seeing appreciation in their homes from the beginning and build out of Phase I to the commencement of building Phase II. You have probably seen the prices on the signs change from Phase I to Phase II where the exact same floorplan started selling $10,000 – $20,000 higher in Phase II than it did in Phase I. Those days of instant appreciation are very rare, so when you purchase your home in an area you expect to experience residential and commercial growth, you, as a homeowner, may have to wait a little bit longer for that long-anticipated

appreciation to come about. Along with the other factors mentioned above, this is yet another reason to wait approximately 5 years before selling and moving to a bigger and better home.

Ron Lee Homes, a home builder in St. Tammany Parish, specializes in 2nd home (and above) move-up homes. Whether you are looking to build a semi-custom or fully custom new home in Mandeville, Covington, Madisonville, or Abita Springs, Ron Lee Homes will work with you and provide base floorplan designs for your consideration. Buying or building a new home can seem a little challenging, but working with the team at Ron Lee Homes will make your home buying / building experience a pleasant and satisfactory process. To get started with the plans for the home of your dreams today, Contact Ron Lee Homes at 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

Thursday, February 11, 2016

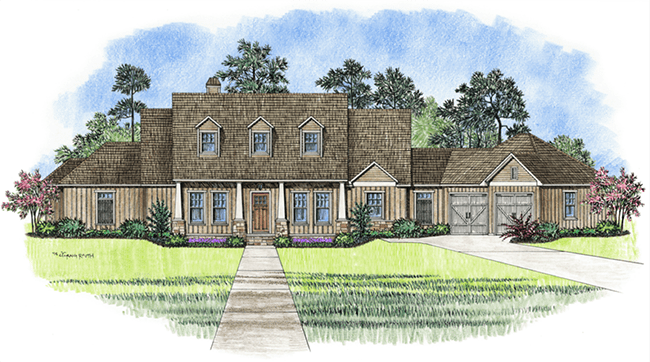

Building a Raffle House for Charity in St. Tammany Parish

The Northshore Home Builders Association (HBA) in St. Tammany Parish

is once again, in 2016, building a Raffle House for Charity called

Raising the Roof for Charity. A new home is constructed by member of

the Home Builders Association of St. Tammany Parish on the North Shore,

and then, this home is auctioned off to raise funds for several chosen

local charities. This year’s recipients include Boys and Girls Club of

Southeast Louisiana, the Covington Food Bank, Habitat for Humanity-St. Tammany West and the Tammany Trace Foundation.

The new Raffle House is being built by Integrity Builders in Spring Haven Subdivision in Madisonville, Louisiana. Tickets are sold by members of the Northshore Home Builders Association

to colleagues and associates in order to raise funds. The HBA will be having two early drawings for Raffle House tickets – one on March 19th and one on April 16th. Winners of these two drawings will receive a $1,500 reward. The final Raffle House drawing will be held at the new, custom home in Spring Haven on June 4, 2016. Special events will be held in the months leading up to the Raffle House drawing where opportunities to win a free raffle ticket will be available.

The new, custom home being built by the St. Tammany Parish builder member is a 2,600 square foot home of living space with 4 bedrooms and 3 baths which was designed by DesignTech Residential Planners. The value of the home is estimated at $422,000. This open floorplan includes a flowing design throughout the living room, dining, room, and kitchen. The living room also has a gorgeous fireplace and coffered ceiling. The kitchen includes an oversized kitchen island with breakfast bar and undermount sink. Granite countertops, real wood cabinetry, and stainless steel appliances complete this deluxe kitchen setup. The master suite features an oversized walk-in closet off of the sumptuous master bath, complete with centered tub with a separate shower flanking. For outdoor entertainment, this new, custom home has a huge, covered outdoor patio, complete with outdoor kitchen setup.

In addition to the grand prize of the Raffle House being given away to a lucky recipient, there will be other prizes given out on the day of the drawing to winning raffle ticket holders. The Raffle House is an important part of raising money for local charities as well as rewarding a St. Tammany Parish resident with a new home. Don’t miss out on your opportunity to view this new, custom home in Madisonville, Louisiana.

The new Raffle House is being built by Integrity Builders in Spring Haven Subdivision in Madisonville, Louisiana. Tickets are sold by members of the Northshore Home Builders Association

to colleagues and associates in order to raise funds. The HBA will be having two early drawings for Raffle House tickets – one on March 19th and one on April 16th. Winners of these two drawings will receive a $1,500 reward. The final Raffle House drawing will be held at the new, custom home in Spring Haven on June 4, 2016. Special events will be held in the months leading up to the Raffle House drawing where opportunities to win a free raffle ticket will be available.

The new, custom home being built by the St. Tammany Parish builder member is a 2,600 square foot home of living space with 4 bedrooms and 3 baths which was designed by DesignTech Residential Planners. The value of the home is estimated at $422,000. This open floorplan includes a flowing design throughout the living room, dining, room, and kitchen. The living room also has a gorgeous fireplace and coffered ceiling. The kitchen includes an oversized kitchen island with breakfast bar and undermount sink. Granite countertops, real wood cabinetry, and stainless steel appliances complete this deluxe kitchen setup. The master suite features an oversized walk-in closet off of the sumptuous master bath, complete with centered tub with a separate shower flanking. For outdoor entertainment, this new, custom home has a huge, covered outdoor patio, complete with outdoor kitchen setup.

In addition to the grand prize of the Raffle House being given away to a lucky recipient, there will be other prizes given out on the day of the drawing to winning raffle ticket holders. The Raffle House is an important part of raising money for local charities as well as rewarding a St. Tammany Parish resident with a new home. Don’t miss out on your opportunity to view this new, custom home in Madisonville, Louisiana.

Click Here For Information on Raffle Tickets.

Click Here for Information on the Raffle House.

Labels:

builder,

builders,

building a new home,

louisiana,

madisonville,

new custom home,

new home,

raffle house for charity,

st. tammany parish

Location:

Madisonville, LA 70447, USA

Subscribe to:

Comments (Atom)