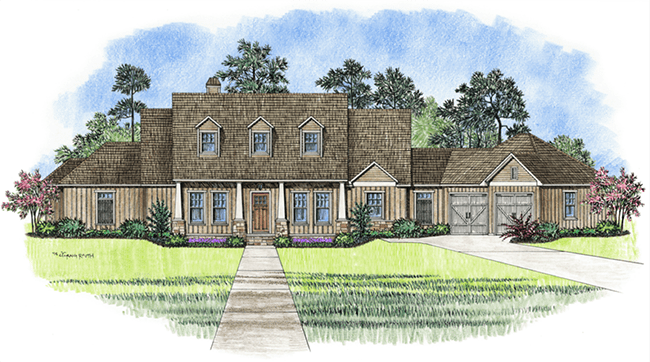

Brentwood Land Development LLC of Mandeville plans to build a new

subdivision off Sharp Road near Mandeville. The new community is slated

to bring 103 new homes to the area. The 104-acres, just south of Most

Holy Trinity Catholic Church, is under contract and is presently owned

by the Archdiocese of New Orleans.

The land is currently zoned A-1 but a request has been approved by the St. Tammany Parish Zoning

Commission

to change the zoning to A-2 with a Planned Unit Development (PUD)

overlay in place. A-2 zoning will allow one home per acre and the PUD

overlay will sanction for smaller lots with 25% of the land used as

green space. The developers plan to keep 66% of the tract green space

which honors the New Directions 2025 land use plan. The new project

proposes one home per acre which is less than most subdivisions which

are built along Sharp Rd. Brentwood Land did a study that revealed the

density in 450-acres of subdivisions in the area is two homes per acre.

Traffic and drainage, two issues that have many residents concerned

over, have been addressed by Brentwood Land. The drainage from the new

community should be 25% less than what is currently draining from the

site. Attorney Jeff Schoen, who represents the archdiocese and Brentwood

Land, supports that the home builder’s drainage report is currently

being completed and the traffic study which was completed this summer

support that the subdivision would not have a huge impact on these two

concerns. “This subdivision should have a place along Sharp Road,”

Schoen said.

This new community will have a great impact on the New Orleans area

real estate market. The builders plan to construct 36 new houses on

estate-size lots that are priced from $400,000 to $450,000, 17 smaller

new homes priced from $350,000 to $400,000 and 50 new construction

garden homes priced from $325,000 to $350,000.

Click Here for the Source of the Information.

We're a Local St. Tammany Parish New Home Builder. This blog will share information about the real estate industry in the Greater New Orleans area and the Northshore of Lake Pontchartrain in particular. Stay tuned for local and industry news regarding new homes!

Friday, October 7, 2016

Thursday, September 29, 2016

Supply & Demand Drives Home Pricing

One of the key factors to success in any kind of business is supply and demand. The National Association of Realtors (NAR)

agrees that this principle has boosted home pricing in the current

housing market. NAR’s chief economist Lawrence Yun believes the housing

market is still going strong because of the lack of inventory even

though data shows a modest growth rate reduction.

Yun states,”…with homebuilding activity still failing to keep up with demand and not enough current homeowners putting their home up for sale, prices continued their strong ascent – and in many markets at a rate well above income growth.”

Yun states,”…with homebuilding activity still failing to keep up with demand and not enough current homeowners putting their home up for sale, prices continued their strong ascent – and in many markets at a rate well above income growth.”

In the second quarter of last year the peak existing single-family home price was $229,400, this year however, the second quarter single-family home price has risen 4.9% with a median single-family home price of $240,700.

According to NAR findings, new construction cannot keep up with the demand for new homes. In the second quarter this year 40% of the listings sold over their listing price. “Many listings in a majority of markets – and especially those in lower price ranges — had multiple offers and went under contract quickly because of severely inadequate supply,” Yun added.

This coupled with low mortgage rates have many potential home buyers

wanting to purchase a new home now. In the Northeast region there was a

7.6% increase in existing homes sales and the median home price

increased to $273,600. The Midwest, though not as high of an increase,

was 10.4% in total existing-home sales with a median price

of $191,300. The West came in next with a 1.4% increase in total

existing-home sales with a median home price of $345,500. The South

came in last with a 0.3% increase with a median home price of $214,900.

This coupled with low mortgage rates have many potential home buyers

wanting to purchase a new home now. In the Northeast region there was a

7.6% increase in existing homes sales and the median home price

increased to $273,600. The Midwest, though not as high of an increase,

was 10.4% in total existing-home sales with a median price

of $191,300. The West came in next with a 1.4% increase in total

existing-home sales with a median home price of $345,500. The South

came in last with a 0.3% increase with a median home price of $214,900.

Whether you are in the market to sell a home or purchase a home, now is the right time. The housing market is holding strong and is a great investment for your money. Locally in St. Tammany Parish, Ron Lee Homes, a new home builder in Covington, Louisiana, is building new homes for sale as well as completely custom homes designed completely from your vision of how you would like your new home to be. We have been keeping a steady pace of new construction for the past 2 years, and we are constantly meeting with new custom home buyers as well as buyers who are looking for homes to buy immediately. If you are interested in building or buying a new home, Contact Us at 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here For the Source of the Information.

Yun states,”…with homebuilding activity still failing to keep up with demand and not enough current homeowners putting their home up for sale, prices continued their strong ascent – and in many markets at a rate well above income growth.”

Yun states,”…with homebuilding activity still failing to keep up with demand and not enough current homeowners putting their home up for sale, prices continued their strong ascent – and in many markets at a rate well above income growth.”In the second quarter of last year the peak existing single-family home price was $229,400, this year however, the second quarter single-family home price has risen 4.9% with a median single-family home price of $240,700.

According to NAR findings, new construction cannot keep up with the demand for new homes. In the second quarter this year 40% of the listings sold over their listing price. “Many listings in a majority of markets – and especially those in lower price ranges — had multiple offers and went under contract quickly because of severely inadequate supply,” Yun added.

This coupled with low mortgage rates have many potential home buyers

wanting to purchase a new home now. In the Northeast region there was a

7.6% increase in existing homes sales and the median home price

increased to $273,600. The Midwest, though not as high of an increase,

was 10.4% in total existing-home sales with a median price

of $191,300. The West came in next with a 1.4% increase in total

existing-home sales with a median home price of $345,500. The South

came in last with a 0.3% increase with a median home price of $214,900.

This coupled with low mortgage rates have many potential home buyers

wanting to purchase a new home now. In the Northeast region there was a

7.6% increase in existing homes sales and the median home price

increased to $273,600. The Midwest, though not as high of an increase,

was 10.4% in total existing-home sales with a median price

of $191,300. The West came in next with a 1.4% increase in total

existing-home sales with a median home price of $345,500. The South

came in last with a 0.3% increase with a median home price of $214,900.Whether you are in the market to sell a home or purchase a home, now is the right time. The housing market is holding strong and is a great investment for your money. Locally in St. Tammany Parish, Ron Lee Homes, a new home builder in Covington, Louisiana, is building new homes for sale as well as completely custom homes designed completely from your vision of how you would like your new home to be. We have been keeping a steady pace of new construction for the past 2 years, and we are constantly meeting with new custom home buyers as well as buyers who are looking for homes to buy immediately. If you are interested in building or buying a new home, Contact Us at 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here For the Source of the Information.

Labels:

existing home sales,

home prices,

home pricing,

home sales,

housing market,

National Association of Realtors,

purchase a home,

realtor,

realtors,

sell a home

Location:

Covington, LA 70433, USA

Wednesday, September 21, 2016

Land in Louisiana Still Available for Building One-Story Homes

New Orleans is a big city with many surrounding suburbs, and even

though it is a populous area, there is still a lot of land in Louisiana

on which to build. The area is less dense than many cities across the

country with very little land constraints. No wonder the US Census

Bureau’s Survey of Construction (SOC) reported that in 2015 that

single-story new construction homes in Louisiana were the highest in the

nation.

The SOC is a monthly and annual report that is organized by the National Association of Home Builders (NAHB) that

surveys important information corresponding to the homebuilding

industry. Examples of data gathered include start and completion dates

of new homes for sale, new homes sales prices, square footage of new

houses and the number of bedrooms in new homes built. The SOC is an

important factor in determining where the country’s economy stands.

The SOC is a monthly and annual report that is organized by the National Association of Home Builders (NAHB) that

surveys important information corresponding to the homebuilding

industry. Examples of data gathered include start and completion dates

of new homes for sale, new homes sales prices, square footage of new

houses and the number of bedrooms in new homes built. The SOC is an

important factor in determining where the country’s economy stands.

Nationwide the data found that 58% of new construction houses built

in 2015 were two or more stories and 42% were one story. The country is

divided between ten divisions, Pacific, Mountain, West North Central,

West South Central, East North Central, East South Central, New England,

Middle Atlantic, and South Atlantic. In the Pacific division 69% were

two or more stories, in the Mountain only 47% were two or more stories,

in West North Central 52% were two or more stories, in West South

Central only 45% were two or more stories, in East North Central only

49% were two or more stories, in East South Central 58% were two or more

stories, in New England 84% were two or more stories, in Middle

Atlantic 80% were two or more stories and in South Atlantic 66% were two or more stories.

Nationwide the data found that 58% of new construction houses built

in 2015 were two or more stories and 42% were one story. The country is

divided between ten divisions, Pacific, Mountain, West North Central,

West South Central, East North Central, East South Central, New England,

Middle Atlantic, and South Atlantic. In the Pacific division 69% were

two or more stories, in the Mountain only 47% were two or more stories,

in West North Central 52% were two or more stories, in West South

Central only 45% were two or more stories, in East North Central only

49% were two or more stories, in East South Central 58% were two or more

stories, in New England 84% were two or more stories, in Middle

Atlantic 80% were two or more stories and in South Atlantic 66% were two or more stories.

The Northeast had the largest number of two or more stories being built in 2015 due to high density with little land which made lot prices very expensive. Luckily Louisiana which is in the West South Central division has reasonable lot prices making it an attractive place to buy a lot and then build a new home. If you happen to live in St. Tammany Parish in Southeast Louisiana, Ron Lee Homes, a new, custom home builder, designs and builds new homes to your specifications on lots that we own, lots that you own, or lots that you may be interested in buying. Land in local subdivisions is plentifully available for new home buyers interested in building their own home. We can even make recommendations as to where you might want to build depending on your life situation, finances, and housing requirements. Contact Us Today to get started talking about building a new, custom home on a local homesite. Call 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

The SOC is a monthly and annual report that is organized by the National Association of Home Builders (NAHB) that

surveys important information corresponding to the homebuilding

industry. Examples of data gathered include start and completion dates

of new homes for sale, new homes sales prices, square footage of new

houses and the number of bedrooms in new homes built. The SOC is an

important factor in determining where the country’s economy stands.

The SOC is a monthly and annual report that is organized by the National Association of Home Builders (NAHB) that

surveys important information corresponding to the homebuilding

industry. Examples of data gathered include start and completion dates

of new homes for sale, new homes sales prices, square footage of new

houses and the number of bedrooms in new homes built. The SOC is an

important factor in determining where the country’s economy stands. Nationwide the data found that 58% of new construction houses built

in 2015 were two or more stories and 42% were one story. The country is

divided between ten divisions, Pacific, Mountain, West North Central,

West South Central, East North Central, East South Central, New England,

Middle Atlantic, and South Atlantic. In the Pacific division 69% were

two or more stories, in the Mountain only 47% were two or more stories,

in West North Central 52% were two or more stories, in West South

Central only 45% were two or more stories, in East North Central only

49% were two or more stories, in East South Central 58% were two or more

stories, in New England 84% were two or more stories, in Middle

Atlantic 80% were two or more stories and in South Atlantic 66% were two or more stories.

Nationwide the data found that 58% of new construction houses built

in 2015 were two or more stories and 42% were one story. The country is

divided between ten divisions, Pacific, Mountain, West North Central,

West South Central, East North Central, East South Central, New England,

Middle Atlantic, and South Atlantic. In the Pacific division 69% were

two or more stories, in the Mountain only 47% were two or more stories,

in West North Central 52% were two or more stories, in West South

Central only 45% were two or more stories, in East North Central only

49% were two or more stories, in East South Central 58% were two or more

stories, in New England 84% were two or more stories, in Middle

Atlantic 80% were two or more stories and in South Atlantic 66% were two or more stories.The Northeast had the largest number of two or more stories being built in 2015 due to high density with little land which made lot prices very expensive. Luckily Louisiana which is in the West South Central division has reasonable lot prices making it an attractive place to buy a lot and then build a new home. If you happen to live in St. Tammany Parish in Southeast Louisiana, Ron Lee Homes, a new, custom home builder, designs and builds new homes to your specifications on lots that we own, lots that you own, or lots that you may be interested in buying. Land in local subdivisions is plentifully available for new home buyers interested in building their own home. We can even make recommendations as to where you might want to build depending on your life situation, finances, and housing requirements. Contact Us Today to get started talking about building a new, custom home on a local homesite. Call 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

Labels:

build new home,

builder,

homebuilding,

homes,

housing industry,

land in louisiana,

new home building,

new homes built,

new homes for sale,

new houses,

sales prices,

square footage,

suburbs

Location:

Covington, LA 70433, USA

Thursday, September 15, 2016

NAHB Works with Congress to Help Low-Income Housing Laws

Without the help of the country’s federal government, many Americans could not see homeownership in their future. The National Association of Home Builders worked with the House of Representatives and the Senate to pass a bill in Congress that would facilitate the chance for low-income Americans to become homeowners. On July 29, 2016, the President signed The Housing Opportunity Through Modernization Act which consists of several reforms which will increase access to affordable rental housing, provide assistance to low-income renters and facilitate homeownership.

There are many facets to the bill which is now a new law. In the past voucher holders had no chance in competing with market-rate renters. Because of red tape in the inspection process, voucher holders were not able to move into a multi-family unit such as an apartment or condominium immediately. Now with the new law inspection requirements in the Housing Choice Voucher Program are more efficient and allow a quicker approval.

The contract terms of HUD’s Section 8 Project Based Housing Choice Voucher program is now 20 years instead of 15 which enables project-based vouchers to be used with the Low Income Housing Tax Credit residences. Voucher holders will now be protected from economic influences that are out of their control, which means that when the market rental rate goes up, voucher holders will not have to be displaced because their payments are not high enough. This also allows property owners to preserve respectable renters.

The Rural Housing Service Single-Family Guaranteed Loan Program will also be updated to compete with other government loan programs. This will allow more low-income renters to actually be able to get a home loan.

FHA regulations that are enforced on existing condominium projects have been reduced. This means that the purchase of a condo will be less stringent in terms of required owner occupancy for the buyer. Buyers will now find it easier to purchase multi-family units for rental purposes, creating more rentals in the market. Also, condo owners who are able to sell will then be able to move up to a single family detached home, if they would like.

Click Here for the Source of the Information.

Labels:

buyer,

buyers,

homeownership,

housing,

HUD,

low income buyer,

owner,

property,

purchase,

vouchers

Location:

Covington, LA 70433, USA

Monday, September 5, 2016

NAHB States Homeownership Is One of the Highest Investments

According to over 80% of Americans surveyed by the National

Association of Home Builders (NAHB), homeownership is one of the highest

and best investments in not only a financial future but also an

emotional and mental future as well. Home provides security in

investment, security in living (the physical walls of the home),

security in family (many couples dream of owning a home to rear their

children), and security in equity in the future.

Homes are one of the largest financial investments that can be made

that will absolutely return money to a homeowner in the form of equity

loans that can be taken out of the house.

According to over 80% of Americans surveyed by the National

Association of Home Builders (NAHB), homeownership is one of the highest

and best investments in not only a financial future but also an

emotional and mental future as well. Home provides security in

investment, security in living (the physical walls of the home),

security in family (many couples dream of owning a home to rear their

children), and security in equity in the future.

Homes are one of the largest financial investments that can be made

that will absolutely return money to a homeowner in the form of equity

loans that can be taken out of the house.Most everyone has heard of the “American Dream” and Leonard Boswell, former U.S. Representative, described it best when he said, “The American Dream is one of success, home ownership, college education for one’s children, and have a secure job to provide these and other goals.” The (NAHB) believes this still holds true in today’s current housing market. According to a polling done in July on over 2,800 registered voters “…..most Americans believe that owning a home remains an integral part of the American Dream and that policymakers need to take active steps to encourage and protect homeownership,” said NAHB Chairman Ed Brady.

The polling was done to explore the American peoples’ perspective on

homeownership, housing production, and government programs that assist

in homeownership. Four out of five Americans still factor homeownership

into the “American Dream’” believing it is still a worthy investment.

The key outcomes of the study were as follows: 82% of Americans feel

that owning a home is the highest of investments, 81% of 18-29 year old

Americans are planning

to purchase a new home, 72% agree that the government providing tax

incentives help fuel homeownership, 46% feel that now is a good time to

purchase a new house and 36% of the Americans surveyed planned to

purchase a new home within the next three years.

The polling was done to explore the American peoples’ perspective on

homeownership, housing production, and government programs that assist

in homeownership. Four out of five Americans still factor homeownership

into the “American Dream’” believing it is still a worthy investment.

The key outcomes of the study were as follows: 82% of Americans feel

that owning a home is the highest of investments, 81% of 18-29 year old

Americans are planning

to purchase a new home, 72% agree that the government providing tax

incentives help fuel homeownership, 46% feel that now is a good time to

purchase a new house and 36% of the Americans surveyed planned to

purchase a new home within the next three years.So with that said, homeownership is still a big part of the “American Dream” and to end with another quote, Maya Angelou describes homeownership as this, “The ache for home lives in all of us, the safe place where we can go as we are and not be questioned.”

Click Here and Here for the Sources of the Information.

Tuesday, August 30, 2016

Lot Values Rise at Record High Rate Nationally

With half as many homes being started before the Recession, a new

record has been set for lots for sale. Not since 2006 has the cost of a

lot exceeded its highest amount of $43,000, but in 2015, the average

cost of a lot was $45,000, which is a record high for lot sales. Lot

values indicate an appreciation in the investment of real estate

nationwide. It is another positive indication of the recovery of the

housing market, and it also allows builders to be able to value the new

homes they build at higher prices as well.

One of the reasons for the increase in lot values is that there is actually a shortage of lots for sale according to the

National Association of Home Builders (NAHB). This lot shortage seems

to be a nationwide problem as the land is available, but developed lots

are scarce. Thanks to the regulatory costs which are going up at a

significant rate, ultimately this translates to a rise in development

costs. The work to develop new lots for sale costs more and thus boosts

the cost and value of the lot.

One of the reasons for the increase in lot values is that there is actually a shortage of lots for sale according to the

National Association of Home Builders (NAHB). This lot shortage seems

to be a nationwide problem as the land is available, but developed lots

are scarce. Thanks to the regulatory costs which are going up at a

significant rate, ultimately this translates to a rise in development

costs. The work to develop new lots for sale costs more and thus boosts

the cost and value of the lot.

Another factor is that the land that is being purchased for development is trending closer to denser urban areas. These areas typically have costlier land because of their location and proximity to the city. Many areas of St. Tammany Parish are located close to shopping, dining, and entertainment hubs – some of which are brand new. Shopping districts around Covington have increased exponentially in the last 8 years requiring a large amount of road construction, expansion, and renovation in order to handle the increase in drivers and traffic.

Luckily, there have been large tracts of land that were zoned residential or had zoning changes to accommodate residential construction close to Covington. These new subdivisions and neighborhoods have been built with the distinct advantage of having lots and homes for sale that had easy access to an unusual amount of social and retail locations that would not typically be associated with quiet, country, bedroom community new home communities. Lot values in the St. Tammany Parish area can be higher than the national average, but they come with amazing community amenities as well as location amenities. There are many new communities springing up in St. Tammany Parish, and Ron Lee Homes, a custom home builder can design and build new custom homes on your lot or on a lot you purchase. Contact Ron Lee Homes Today by calling 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

One of the reasons for the increase in lot values is that there is actually a shortage of lots for sale according to the

National Association of Home Builders (NAHB). This lot shortage seems

to be a nationwide problem as the land is available, but developed lots

are scarce. Thanks to the regulatory costs which are going up at a

significant rate, ultimately this translates to a rise in development

costs. The work to develop new lots for sale costs more and thus boosts

the cost and value of the lot.

One of the reasons for the increase in lot values is that there is actually a shortage of lots for sale according to the

National Association of Home Builders (NAHB). This lot shortage seems

to be a nationwide problem as the land is available, but developed lots

are scarce. Thanks to the regulatory costs which are going up at a

significant rate, ultimately this translates to a rise in development

costs. The work to develop new lots for sale costs more and thus boosts

the cost and value of the lot.Another factor is that the land that is being purchased for development is trending closer to denser urban areas. These areas typically have costlier land because of their location and proximity to the city. Many areas of St. Tammany Parish are located close to shopping, dining, and entertainment hubs – some of which are brand new. Shopping districts around Covington have increased exponentially in the last 8 years requiring a large amount of road construction, expansion, and renovation in order to handle the increase in drivers and traffic.

Luckily, there have been large tracts of land that were zoned residential or had zoning changes to accommodate residential construction close to Covington. These new subdivisions and neighborhoods have been built with the distinct advantage of having lots and homes for sale that had easy access to an unusual amount of social and retail locations that would not typically be associated with quiet, country, bedroom community new home communities. Lot values in the St. Tammany Parish area can be higher than the national average, but they come with amazing community amenities as well as location amenities. There are many new communities springing up in St. Tammany Parish, and Ron Lee Homes, a custom home builder can design and build new custom homes on your lot or on a lot you purchase. Contact Ron Lee Homes Today by calling 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

Labels:

covington,

developed lots,

developer lots,

development,

lot,

lot sales,

lot value,

lot values,

lots for sale,

louisiana,

new lots for sale,

residential construction,

st. tammany parish

Location:

Covington, LA 70433, USA

Monday, August 22, 2016

What to Know About Researching Your Loan

An article written on a popular website begins with the assumption

that you, as the home buyer, are aware that you have the choice to shop

your lender. So let’s start there with the discussion of what you

should be learning from the company which is going to be lending you

money for what could be the most important investment of your life.

Another big chunk of your closing costs is the cost of your escrow account, if you are doing one. There is a deposit into your escrow account that is for your taxes and insurance. If you haven’t yet shopped for the most competitive rate for your homeowner’s insurance, you should definitely do that before you choose your lender or title company. Your insurance rate accounts for the amount of money that is added to your loan each month in order to pay your annual premium. The better the rate, the lower the deposit and the lower monthly payment.

On the flip side, you should find out if there are any credits available to you depending on the type of loan that you are getting. Some lenders are authorized to credit up to a certain amount of money depending on the loan-to-value ratio or the type of loan they are doing. If you are pulling money out of the loan for renovations or to create a home equity line of credit, make sure you get the most amount of money you can at the best interest rate.

You should find out what interest rates are offered and how much points would be if you chose to “buy down” your interest rate. Many people don’t know about points, and lenders can sometimes add them into the cost of the loan in order to advertise a better rate to the home buyer. Make sure that you are getting the base cost of the loan and then the cost of points. Your lender can break down for you how the cost of points can save you money in the long run by showing how you “pay off” your points and still ssave money of your monthly payments.

Secondly, when you are finding out about the type of loan available to you, find out the specific information about the down payment. Lending restrictions have loosened up in the last couple of years, so a 20% down payment is not necessarily required anymore to get a loan.

If you are able to obtain a fabulous rate, make SURE to find out exactly when you are required to close if you lock-in your rate in order to be able to keep that excellent rate for closing. Locking in your rate means, though, that you can’t get a better rate later on, so if you feel like your closing can happen fast, and you have the best rate, go ahead and lock it down to get the most savings.

Click Here for the Source of the Information.

Researching Your Loan

As a home buyer, you have the right to shop your mortgage. You can and should contact as many lenders, banks, and / or mortgage companies as possible and ask them the costs on application fees, appraisal fees, and the breakdown of your closing costs. Specifically with your closing costs, you will want to check to see if they are a mortgage broker or if they are the company that has the underwriter who will approve your loan. A mortgage broker can incur additional fees on top of your loan origination fees. When you contact your lender, you are going to be asking them what their loan origination fees are. This is a way to “weed out” any unknown loan companies which may have higher fees.Know Your Title Company

You, as the home buyer, do have some say in the title company that is used by the lender. The lender works with specific title companies, therefore sometimes gets a better rate that you would as an individual. However, if you are interested in cross-checking their rates, you can get quotes from title companies as well to make sure that you are not overpaying for those services.Another big chunk of your closing costs is the cost of your escrow account, if you are doing one. There is a deposit into your escrow account that is for your taxes and insurance. If you haven’t yet shopped for the most competitive rate for your homeowner’s insurance, you should definitely do that before you choose your lender or title company. Your insurance rate accounts for the amount of money that is added to your loan each month in order to pay your annual premium. The better the rate, the lower the deposit and the lower monthly payment.

On the flip side, you should find out if there are any credits available to you depending on the type of loan that you are getting. Some lenders are authorized to credit up to a certain amount of money depending on the loan-to-value ratio or the type of loan they are doing. If you are pulling money out of the loan for renovations or to create a home equity line of credit, make sure you get the most amount of money you can at the best interest rate.

Hidden Fees / Down Payment

Once you have done all of your research mentioned above, don’t forget to check with your lender on the following items:You should find out what interest rates are offered and how much points would be if you chose to “buy down” your interest rate. Many people don’t know about points, and lenders can sometimes add them into the cost of the loan in order to advertise a better rate to the home buyer. Make sure that you are getting the base cost of the loan and then the cost of points. Your lender can break down for you how the cost of points can save you money in the long run by showing how you “pay off” your points and still ssave money of your monthly payments.

Secondly, when you are finding out about the type of loan available to you, find out the specific information about the down payment. Lending restrictions have loosened up in the last couple of years, so a 20% down payment is not necessarily required anymore to get a loan.

If you are able to obtain a fabulous rate, make SURE to find out exactly when you are required to close if you lock-in your rate in order to be able to keep that excellent rate for closing. Locking in your rate means, though, that you can’t get a better rate later on, so if you feel like your closing can happen fast, and you have the best rate, go ahead and lock it down to get the most savings.

Click Here for the Source of the Information.

Labels:

bank,

banks,

closing costs,

home buyer,

interest rate,

interest rates,

lender,

lending,

mortgage,

mortgages,

points,

rate,

rates,

title costs

Location:

Covington, LA 70433, USA

Thursday, August 11, 2016

National Lot Size Average Helps Builders and Home Buyers

The number of jobs available in the construction sector have become a

positive “negative” for the United States’ real estate market.

Employers are reporting more open positions for construction employees

and sub-contractors. This shortage of workers is actually contributing

greatly to the slow completion of new homes for

sale on the market. However, new home sales for single-family detached

homes has increased 13% year-over-year, reporting 592,000 homes

completed in June, 2016. Lot size has also started to play a role in

the completion of new homes for builders in an unexpected way. The lack

of developed lots has also slowed down new home builders as they are

trying to keep up with the demand from new home buyers in the housing

market.

The number of jobs available in the construction sector have become a

positive “negative” for the United States’ real estate market.

Employers are reporting more open positions for construction employees

and sub-contractors. This shortage of workers is actually contributing

greatly to the slow completion of new homes for

sale on the market. However, new home sales for single-family detached

homes has increased 13% year-over-year, reporting 592,000 homes

completed in June, 2016. Lot size has also started to play a role in

the completion of new homes for builders in an unexpected way. The lack

of developed lots has also slowed down new home builders as they are

trying to keep up with the demand from new home buyers in the housing

market. However, there is a “silver lining” to the lack of developed lots.

Builders may find that they don’t have to look as hard for lots on which

to build because the Census Bureau’s Survey of Construction (SOC) found

that new home buyers preferred lots that were less than 8,600 square

feet – approximately 1/5-acre lots. Since an acre is 43,560 square

feet, this means that approximately 5 homes could fit comfortably on a

space the size of a football field. This is also good news for

first-time home buyers. The types and sizes of homes that would fit on a

1/5-acre lot would probably fall within the price range of the

first-time home buyers. Most builders paying attention to housing

trends build new homes based on buyers’ preferences. As lot sizes

decrease, the availability of affordable housing has the potential to

increase.

However, there is a “silver lining” to the lack of developed lots.

Builders may find that they don’t have to look as hard for lots on which

to build because the Census Bureau’s Survey of Construction (SOC) found

that new home buyers preferred lots that were less than 8,600 square

feet – approximately 1/5-acre lots. Since an acre is 43,560 square

feet, this means that approximately 5 homes could fit comfortably on a

space the size of a football field. This is also good news for

first-time home buyers. The types and sizes of homes that would fit on a

1/5-acre lot would probably fall within the price range of the

first-time home buyers. Most builders paying attention to housing

trends build new homes based on buyers’ preferences. As lot sizes

decrease, the availability of affordable housing has the potential to

increase.In Louisiana, the SOC reported that new home buyers buying single-family homes in Louisiana prefer lot sizes that are .16-acre. This is less than the national trend of 1/5 acre. Ron Lee Homes in St. Tammany Parish Louisiana can design and build you a completely custom new home either on a lot you already own or on any new lot for sale in the new subdivisions in the West St. Tammany Parish area. We also have garden home floorplans and smaller square footage floorplans that have been designed and engineered for smaller lots. New home buyers frequently modify our previously designed floorplans to their specifications in order to have Ron Lee Homes build the home of their dreams. If you already own your lot or would like to buyer a lot in one of the many neighborhoods throughout the St. Tammany Parish area, Contact Us Today, Call 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here and Here for the Sources of the Information.

Labels:

build the home,

community,

home buyers,

lot size,

lots for sale,

louisiana,

neighborhood,

new homes,

single-family homes,

st. tammany parish,

subdivision

Location:

Covington, LA 70433, USA

Friday, August 5, 2016

Cultural Arts District to Move Forward in St. Tammany Parish

St. Tammany Parish will enjoy the benefits of the design and

construction of a new arts and education district in 48 acres north of

I-12 between the Pinnacle at Nord du Lac shopping center and the

Tchefuncte River. Despite many ups and downs along the way, including

the governor’s veto of $11 million in assistance for the construction

project, parish president Pat Brister will realize her vision of

creating not only a cultural arts district but also an educational

facility and program for students on

the North Shore, including the Tangipahoa Parish area.

The entire property includes plans for the cultural arts district, the center of which would be a performing arts center, a children’s museum, and a privately owned commercial development with possibly a hotel and restaurant. Donation of land for a theater and amphitheater as well as planned nature trails along the river are also part of the project.

Real estate developer Bruce Wainer of All State Financial owns the 48 acres as well as the 80 acres that are adjacent to it. He plans on donating the land for the children’s museum and the performing arts center which will help alleviate the costs, now that the state government is currently unable to contribute. The natural part of the property includes wetlands, a river, and a heavily wooded area which will offset the commercial atmosphere of the entire development.

Design elements are being prepared by a team of architects and planners which include Wilson Butler Architects of Boston headed by Scott Wilson, and Fisher Dachs Associates of New York. Wilson’s vision of the area is that of constant activity both day and night for “kids of all ages.”

“Most performing arts centers are urban,” he said. “Very few projects of this nature have such a pristine, undamaged, unmolested site. It’s a huge responsibility for us to do it right.

“Clearly the land, the trees, the wetlands are your jewel. For us to not really capture that would be a big mistake.”

Even though the funding did not come through as planned, Brister is undettered. Brister, who invited members of the news media to attend part of Wednesday’s session, said the parish government didn’t embark on the project thinking all of the funding would simply fall into place. She said the parish is fully prepared to move ahead with planning and will talk with Edwards about future funding. In addition Brister said St. Tammany will look for money from cultural arts grants, economic development districts, naming rights and private sources.

Click Here and Here for the Sources of the Information.

the North Shore, including the Tangipahoa Parish area.

The entire property includes plans for the cultural arts district, the center of which would be a performing arts center, a children’s museum, and a privately owned commercial development with possibly a hotel and restaurant. Donation of land for a theater and amphitheater as well as planned nature trails along the river are also part of the project.

Real estate developer Bruce Wainer of All State Financial owns the 48 acres as well as the 80 acres that are adjacent to it. He plans on donating the land for the children’s museum and the performing arts center which will help alleviate the costs, now that the state government is currently unable to contribute. The natural part of the property includes wetlands, a river, and a heavily wooded area which will offset the commercial atmosphere of the entire development.

Design elements are being prepared by a team of architects and planners which include Wilson Butler Architects of Boston headed by Scott Wilson, and Fisher Dachs Associates of New York. Wilson’s vision of the area is that of constant activity both day and night for “kids of all ages.”

“Most performing arts centers are urban,” he said. “Very few projects of this nature have such a pristine, undamaged, unmolested site. It’s a huge responsibility for us to do it right.

“Clearly the land, the trees, the wetlands are your jewel. For us to not really capture that would be a big mistake.”

Even though the funding did not come through as planned, Brister is undettered. Brister, who invited members of the news media to attend part of Wednesday’s session, said the parish government didn’t embark on the project thinking all of the funding would simply fall into place. She said the parish is fully prepared to move ahead with planning and will talk with Edwards about future funding. In addition Brister said St. Tammany will look for money from cultural arts grants, economic development districts, naming rights and private sources.

Click Here and Here for the Sources of the Information.

Thursday, July 28, 2016

Single-Family Home Sales Increase in 2nd Quarter

Single-family home sales increased by almost 24% compared to new home

sales in 2015 in April. Compared to March, 2016’s home sales,

single-family home sales increased by almost 17%. Finally, sales went

up to 619,000, an eight-year high during the month of April as well.

Home buyers are taking advantage of the availability of new homes because the inventory of new homes for sale

on the market has decreased to a 4.7 month’s supply – a total of

243,000 new homes for sale with only 56,000 completed, move-in ready

homes available. Demand will require that builders increase their

production of new homes for sale in order to keep up with the buyers.

Home buyers are taking advantage of the availability of new homes because the inventory of new homes for sale

on the market has decreased to a 4.7 month’s supply – a total of

243,000 new homes for sale with only 56,000 completed, move-in ready

homes available. Demand will require that builders increase their

production of new homes for sale in order to keep up with the buyers.

April’s sales numbers go hand-in-hand with the reported new,

single-family home starts which increased by 3.3% at the beginning of

April. Builder confidence held steady for the 4th month in a row since

February, 2016, which contributed to new construction starts and

inventory on the ground. Single-family home permits in the beginning of

April were already up year-over-year by 8.4%, so construction of new

homes should continue to escalate over the next few months.

April’s sales numbers go hand-in-hand with the reported new,

single-family home starts which increased by 3.3% at the beginning of

April. Builder confidence held steady for the 4th month in a row since

February, 2016, which contributed to new construction starts and

inventory on the ground. Single-family home permits in the beginning of

April were already up year-over-year by 8.4%, so construction of new

homes should continue to escalate over the next few months.

While first-time home buyers are finding it difficult to find new homes for sale in their price range, the sales of homes priced from $150,000 – $200,000 increased to 10,000 sales in April. For existing home sales, the first-time home buyer sales accounted for 32% of these sales, opening up the market, once again for homes priced affordably.

The 2nd quarter of 2016 shows good news for the housing market after a slow 1st quarter start. New, single-family home starts and permits indicate an increase in new home inventory moving forward in the 3rd quarter. Sellers should be able to “take their pick” of home buyers as supply currently is lagging behind demand.

Click Here and Here for the Sources of the Information.

Home buyers are taking advantage of the availability of new homes because the inventory of new homes for sale

on the market has decreased to a 4.7 month’s supply – a total of

243,000 new homes for sale with only 56,000 completed, move-in ready

homes available. Demand will require that builders increase their

production of new homes for sale in order to keep up with the buyers.

Home buyers are taking advantage of the availability of new homes because the inventory of new homes for sale

on the market has decreased to a 4.7 month’s supply – a total of

243,000 new homes for sale with only 56,000 completed, move-in ready

homes available. Demand will require that builders increase their

production of new homes for sale in order to keep up with the buyers.Single-Family Home Builders

April’s sales numbers go hand-in-hand with the reported new,

single-family home starts which increased by 3.3% at the beginning of

April. Builder confidence held steady for the 4th month in a row since

February, 2016, which contributed to new construction starts and

inventory on the ground. Single-family home permits in the beginning of

April were already up year-over-year by 8.4%, so construction of new

homes should continue to escalate over the next few months.

April’s sales numbers go hand-in-hand with the reported new,

single-family home starts which increased by 3.3% at the beginning of

April. Builder confidence held steady for the 4th month in a row since

February, 2016, which contributed to new construction starts and

inventory on the ground. Single-family home permits in the beginning of

April were already up year-over-year by 8.4%, so construction of new

homes should continue to escalate over the next few months.While first-time home buyers are finding it difficult to find new homes for sale in their price range, the sales of homes priced from $150,000 – $200,000 increased to 10,000 sales in April. For existing home sales, the first-time home buyer sales accounted for 32% of these sales, opening up the market, once again for homes priced affordably.

Good News for Resale Market

Existing home sale closings increased by 6% year-over-year and by 1.7% compared to March’s sales. It is definitely a seller’s market right now as existing home inventory also stands at a 4.7 month supply like single-family new homes.The 2nd quarter of 2016 shows good news for the housing market after a slow 1st quarter start. New, single-family home starts and permits indicate an increase in new home inventory moving forward in the 3rd quarter. Sellers should be able to “take their pick” of home buyers as supply currently is lagging behind demand.

Click Here and Here for the Sources of the Information.

Friday, July 22, 2016

New Construction Jobs Support Overall GDP

Home building generates a substantial amount of money for local

governments and the federal government just by the nature of the

industry. According to the National Association of Home Builders,

approximately 90,000 different governments receive approximately $111

million in taxes and fees from the construction and building of 1,000

single-family homes.

sub-contractors also are reported to make consistently higher wages because of home building. One of the reasons for this is that sub-contractors actually do the work themselves instead of hiring the jobs out to employees. Because sub-contractors make up the majority of the workforce when building a new home, the taxes on profit then paid by these sole proprietors also contribute greatly to the overall economy.

A breakdown of industries which bring in the revenue shows that construction has the most jobs, and other affiliated companies related to construction such as manufacturing, bring in other revenue. Other affiliated businesses include trade, transportation, warehousing, finance, insurance, real estate sales, rental and leasing, and professional, management, and admin services. A total of 2,975 jobs are created from building 1,000 single-family homes based on full-time jobs over one year.

Click Here for the Source of the Information.

Sub-Contractors Contribute Greatest Share

In addition to the governments making a substantial amount of money from home building,sub-contractors also are reported to make consistently higher wages because of home building. One of the reasons for this is that sub-contractors actually do the work themselves instead of hiring the jobs out to employees. Because sub-contractors make up the majority of the workforce when building a new home, the taxes on profit then paid by these sole proprietors also contribute greatly to the overall economy.

Tax Breakdown

The amount of taxes paid to the federal government is comprised mainly of income taxes and social security equaling an amount of $74.4 million. State and local income taxes comes to $10.3 million, and city and county taxes equal approximately $6.9 million. Other taxes consisting of impact fees, permit fees, and other fees for new construction bring in a total of $13.7 million.A breakdown of industries which bring in the revenue shows that construction has the most jobs, and other affiliated companies related to construction such as manufacturing, bring in other revenue. Other affiliated businesses include trade, transportation, warehousing, finance, insurance, real estate sales, rental and leasing, and professional, management, and admin services. A total of 2,975 jobs are created from building 1,000 single-family homes based on full-time jobs over one year.

Click Here for the Source of the Information.

Wednesday, July 13, 2016

Interest Rates to Remain the Same According to the Fed

A unanimous decision by the Federal Reserve the first week of June

declared that interest rates would remain the way they were. This

decision was made after reports revealed that the labor market is still

not showing a strong recovery. Even though there are still job gains

across the board, they are slow and business investment has also not

picked up.

Home buyers have enjoyed and even taken for granted interest rates that are historically low for the past 10+ years.

For those buyers who have been able to recover and succeed after the

Great Recession, it is still one of the best times to buy a new home or

buy an existing home in today’s housing market.

Home buyers have enjoyed and even taken for granted interest rates that are historically low for the past 10+ years.

For those buyers who have been able to recover and succeed after the

Great Recession, it is still one of the best times to buy a new home or

buy an existing home in today’s housing market.

The good news is that the unemployment rate went down by 4.7%, but the gain of jobs in May, 2016, was only 38,000. Also, the job increases reported in March and April were revised down by 59,000 – a loss of 458,000 in the labor force.

Strong demand still exists for employees and contractors in the residential construction sector. The BLS JOLTS data shows that builders have approximately 200,000 unfilled positions. However, during the course of April and May, 9,600 jobs were lost in the residential construction industry, and these jobs are now having to be refilled.

New home buyers in the market to purchase a new home will still benefit greatly from the significantly and historically low interest rates. Any rise in the interest rate in 2016 will still probably keep the interest rate low enough to have affordable house payments.

Click Here for the Source of the Information.

Home buyers have enjoyed and even taken for granted interest rates that are historically low for the past 10+ years.

For those buyers who have been able to recover and succeed after the

Great Recession, it is still one of the best times to buy a new home or

buy an existing home in today’s housing market.

Home buyers have enjoyed and even taken for granted interest rates that are historically low for the past 10+ years.

For those buyers who have been able to recover and succeed after the

Great Recession, it is still one of the best times to buy a new home or

buy an existing home in today’s housing market.Predicted Rise in Interest Rate

Originally, the “Fed” had predicted that there would be two more rate hikes of the interest rate during 2016, but June’s meeting saw 6 members stating that with the slow growth of the economy, they only would really commit to a possibility of one more interest rate increase, citing the normalization of monetary policy taking a longer period of time than expected.The good news is that the unemployment rate went down by 4.7%, but the gain of jobs in May, 2016, was only 38,000. Also, the job increases reported in March and April were revised down by 59,000 – a loss of 458,000 in the labor force.

Strong demand still exists for employees and contractors in the residential construction sector. The BLS JOLTS data shows that builders have approximately 200,000 unfilled positions. However, during the course of April and May, 9,600 jobs were lost in the residential construction industry, and these jobs are now having to be refilled.

First-Time Home Buyers

Because of the cost of labor and materials to build a new home, first-time home buyers are finding it hard to acquire a new home. Homes that are priced less than $150,000 account for only 6% of the market according to the National Association of Home Builders. Currently approximately 31% of the home buyers surveyed expected to be able to pay less than $150,000 for their new home.New home buyers in the market to purchase a new home will still benefit greatly from the significantly and historically low interest rates. Any rise in the interest rate in 2016 will still probably keep the interest rate low enough to have affordable house payments.

Click Here for the Source of the Information.

Friday, July 8, 2016

Tax Credits Still Available for Energy Efficient Home Features

New homes which are “green-built” to reduce energy consumption have

several benefits to new home buyers. Many people don’t know that tax

credits are still available for the use of energy efficient home

features. First of all, because of the usage of the proper insulation,

tightly sealed caulking and weather stripping, the home’s interior

temperature is more comfortable. Through the control of air and vapor

through the use of air/vapor retarder systems, the humidity of the home

is reduced significantly making it a more dry environment. Because of

the insulation and tightly sealed yet ventilated structure of the home,

there is a reduction of a significant amount of noise as well. All of

these factors contribute to a peaceful and comfortable living

environment for our new homeowners.

New homes which are “green-built” to reduce energy consumption have

several benefits to new home buyers. Many people don’t know that tax

credits are still available for the use of energy efficient home

features. First of all, because of the usage of the proper insulation,

tightly sealed caulking and weather stripping, the home’s interior

temperature is more comfortable. Through the control of air and vapor

through the use of air/vapor retarder systems, the humidity of the home

is reduced significantly making it a more dry environment. Because of

the insulation and tightly sealed yet ventilated structure of the home,

there is a reduction of a significant amount of noise as well. All of

these factors contribute to a peaceful and comfortable living

environment for our new homeowners.At Ron Lee Homes, we use many different energy efficient building techniques. Because he is Green Building Certified through the National Association of Home Builders, Ron Lee is an expert on applying the latest trends and technologies in building green homes. Currently, the federal government is offering tax rebates for two different types of energy efficiencies: the Residential Energy Efficient Property Tax Credit, which benefits those who have incorporated renewable energy features into their home, and the Nonbusiness Energy Property Tax Credit, which benefits those who have installed materials that meet the U.S. Department of Energy’s energy efficiency standards.

Energy Efficient Materials

In order to clarify exactly which types of materials will help you in

renovating and updating your home, saving you money on your utility

bills, and receiving money off of the annual taxes you pay, Ron Lee

Homes has provided a description of all of the potential changes or new

building techniques you can use that are considered energy efficient enough for the IRS.

In order to clarify exactly which types of materials will help you in

renovating and updating your home, saving you money on your utility

bills, and receiving money off of the annual taxes you pay, Ron Lee

Homes has provided a description of all of the potential changes or new

building techniques you can use that are considered energy efficient enough for the IRS.First of all, for new home building, you will want to make sure that your thermal envelope is designed and installed to help reduce moisture and air from flowing through your home. Your thermal envelope includes the wall and roof, insulation, air / vapor retarders which reduce water vapor condensation, windows, weather stripping, and caulking.

A typical home loses more than 25% of its heat through its windows. In addition to using Energy Star® rated double or triple-paned, energy efficient windows, something as simple as roof overhangs are excellent at providing shade keeping the heat and sun glare off of the sides of the house as well as the windows especially here in Southeast Louisiana.

Amazingly, properly applied caulking and weather stripping will reduce a home’s utility costs by 50%. Sealing all of the potential places that air and moisture can escape or come into your home can enormously change your home’s environment – creating a less humid place to live with more stable temperatures.

Choosing the properly-sized heating and cooling system and then creating ventilation and air re-usage opportunities throughout the home will let the home “breathe,” which helps with reducing hot and cold air when it is not necessary.

Energy Star® water heaters, refrigerators, washing machines, dryers, dishwashers, lighting, and room air conditioners should be chosen to decrease entergy usage which makes it cost less to use your home appliances.

For more information about building a new home with energy efficient features or renvoting your current home with these features, Contact Ron Lee Homes at 985-626-7619 or E-mail Info@RonLeeHomes.com.

Click Here for the Source of the Information.

Friday, June 24, 2016

NAHB Survey Shows Desire for Better Amenities Among Remodelers

Among the many reasons for remodeling your home, the National

Association of Home Builders surveyed homeowners and found that the top

reason for a remodel was a desire for better / newer amenities. In

conjunction with this reason, homeowners’ second reason for remodeling

their current home was a need to repair / replace old components.

In order for a home to feel like “brand new,” homeowners can largely do an overhaul of their existing space, replacing

or adding trim, repainting, putting down different flooring, replacing

cabinets and countertops, and installing new fixtures, lighting, and

appliances. The desire for new and better amenities includes all of

these activities and also includes installing new components whether

they be new faucets, sinks, toilets, tubs, showers, shower stalls /

doors, kitchen islands, and much, much more. Unused wall space can

include new cabinetry, a kitchen desk or mini-office, a butler’s pantry,

or a built-in wet bar designed specifically for entertaining, complete

with ice maker, refrigerator, and / or wine cooler.

In order for a home to feel like “brand new,” homeowners can largely do an overhaul of their existing space, replacing

or adding trim, repainting, putting down different flooring, replacing

cabinets and countertops, and installing new fixtures, lighting, and

appliances. The desire for new and better amenities includes all of

these activities and also includes installing new components whether

they be new faucets, sinks, toilets, tubs, showers, shower stalls /

doors, kitchen islands, and much, much more. Unused wall space can

include new cabinetry, a kitchen desk or mini-office, a butler’s pantry,

or a built-in wet bar designed specifically for entertaining, complete

with ice maker, refrigerator, and / or wine cooler.

Other reasons for remodeling your home can include wanting to avoid

moving or buying a new or existing home for sale, the ability or desire

to stay where you are – age in place. If you have children, you may

love the area in which you live, your kids love their school, and you

like the school district, your neighborhood is desirable and your

neighbors are your friends, and other reasons for “staying put.” Your

home may not no longer be meeting your expectations for comfortable

living, but remodeling your home to give it a fresh look or even adding

on more space in the form of an expanded family room area, a new sun

room, a new patio / screened-in porch, a mother-in-law suite, or even an

upstairs apartment above your garage could make your life and your

family’s life more enjoyable.

Other reasons for remodeling your home can include wanting to avoid

moving or buying a new or existing home for sale, the ability or desire

to stay where you are – age in place. If you have children, you may

love the area in which you live, your kids love their school, and you

like the school district, your neighborhood is desirable and your

neighbors are your friends, and other reasons for “staying put.” Your

home may not no longer be meeting your expectations for comfortable

living, but remodeling your home to give it a fresh look or even adding

on more space in the form of an expanded family room area, a new sun

room, a new patio / screened-in porch, a mother-in-law suite, or even an

upstairs apartment above your garage could make your life and your

family’s life more enjoyable.

Whatever your reason for remodeling your home, Ron Lee Homes in St. Tammany Parish can help. We have added entire outdoor space, completely reconstructed kitchens and bathrooms, and created private master suites for more comfort while you age in place. To get more information on renovating your home with Ron Lee Homes, call 985-626-7619 or E-mail Info@RonLeeHomes.com.

In order for a home to feel like “brand new,” homeowners can largely do an overhaul of their existing space, replacing

or adding trim, repainting, putting down different flooring, replacing

cabinets and countertops, and installing new fixtures, lighting, and

appliances. The desire for new and better amenities includes all of

these activities and also includes installing new components whether

they be new faucets, sinks, toilets, tubs, showers, shower stalls /

doors, kitchen islands, and much, much more. Unused wall space can

include new cabinetry, a kitchen desk or mini-office, a butler’s pantry,

or a built-in wet bar designed specifically for entertaining, complete

with ice maker, refrigerator, and / or wine cooler.

In order for a home to feel like “brand new,” homeowners can largely do an overhaul of their existing space, replacing

or adding trim, repainting, putting down different flooring, replacing

cabinets and countertops, and installing new fixtures, lighting, and

appliances. The desire for new and better amenities includes all of

these activities and also includes installing new components whether

they be new faucets, sinks, toilets, tubs, showers, shower stalls /

doors, kitchen islands, and much, much more. Unused wall space can

include new cabinetry, a kitchen desk or mini-office, a butler’s pantry,

or a built-in wet bar designed specifically for entertaining, complete

with ice maker, refrigerator, and / or wine cooler. Other reasons for remodeling your home can include wanting to avoid

moving or buying a new or existing home for sale, the ability or desire

to stay where you are – age in place. If you have children, you may

love the area in which you live, your kids love their school, and you

like the school district, your neighborhood is desirable and your

neighbors are your friends, and other reasons for “staying put.” Your

home may not no longer be meeting your expectations for comfortable

living, but remodeling your home to give it a fresh look or even adding

on more space in the form of an expanded family room area, a new sun

room, a new patio / screened-in porch, a mother-in-law suite, or even an

upstairs apartment above your garage could make your life and your

family’s life more enjoyable.

Other reasons for remodeling your home can include wanting to avoid

moving or buying a new or existing home for sale, the ability or desire

to stay where you are – age in place. If you have children, you may

love the area in which you live, your kids love their school, and you

like the school district, your neighborhood is desirable and your

neighbors are your friends, and other reasons for “staying put.” Your

home may not no longer be meeting your expectations for comfortable

living, but remodeling your home to give it a fresh look or even adding

on more space in the form of an expanded family room area, a new sun

room, a new patio / screened-in porch, a mother-in-law suite, or even an

upstairs apartment above your garage could make your life and your

family’s life more enjoyable.Whatever your reason for remodeling your home, Ron Lee Homes in St. Tammany Parish can help. We have added entire outdoor space, completely reconstructed kitchens and bathrooms, and created private master suites for more comfort while you age in place. To get more information on renovating your home with Ron Lee Homes, call 985-626-7619 or E-mail Info@RonLeeHomes.com.

Labels:

adding square footage,

better amenities,

expansion of home,

homeowners,

new amenities,

new appliances,

new countertops,

remodel,

renovate,

replace components

Location:

Covington, LA 70433, USA

Friday, June 17, 2016

FHA Backed Loans Reported to Have Slight Increase

Certain pricing requirements, mortgage types, and age requirements

are considered a trend for first-time home buyers. Different housing

market statistics are indicating that first-time home buyers may soon be

increasing to pre-Recession levels. The first indication was a slight

uptick in FHA (Federal Housing Authority) backed loans.

With the recent easement of FHA loan requirements including a lower

percentage required for the down payment, more first-time home buyers

are able to qualify for FHA mortgages. The increase in FHA-backed

mortgages went up to a 17% market share for a quarterly count of 23,000

FHA loans in the 1st quarter of 2016.

Certain pricing requirements, mortgage types, and age requirements

are considered a trend for first-time home buyers. Different housing

market statistics are indicating that first-time home buyers may soon be

increasing to pre-Recession levels. The first indication was a slight

uptick in FHA (Federal Housing Authority) backed loans.

With the recent easement of FHA loan requirements including a lower

percentage required for the down payment, more first-time home buyers

are able to qualify for FHA mortgages. The increase in FHA-backed

mortgages went up to a 17% market share for a quarterly count of 23,000

FHA loans in the 1st quarter of 2016.Pre-Recession Trends

Interestingly, in 2002 – 2003, well before the Great Recession, FHA backed mortgages were only 10% of the market share where in 2010, FHA loans had a 28% share of the housing market. These statistics show a steady presence of FHA loans in real estate transactions. It also indicates the necessity of a government supported loan program for struggling Americans who need assistance with their new home purchase.

Conventional home financing still makes up the majority of home purchases in America today. For the first quarter of 2016, Conventional loans made up 68% of the homes achieved by home buyers. The reason for this may be another market statistic which showed an overall increase of in personal income in the United States. a 2.2% year-over-year increase for 2014 was reported with median income reported at $28,757. This is 5.4% less than its high in 2007 right before the Recession, and it is still lower than income reported in 20000, but statistics show the trend of the total of personal income is and has been on the rise since it bottomed out in 2012.

Click Here and Here for the Sources of the Information.

Labels:

credit,

FHA backed mortgages,

FHA loan,

first-time home buyers,

housing market,

lenders,

new home buyers,

qualify for a home mortgage

Location:

Covington, LA 70433, USA

Monday, June 13, 2016

National Association of Home Builders Announces Positive Housing Recovery

According to the National Association of Home Builders’ (NAHB)

Leading Markets Index (LMI), the national housing market is within a 5%

range of complete housing recovery compared to what is considered a

“normal” housing market which the United States last saw in 2006. Out

of a score of one, the latest LMI scored a .95 nationwide in housing

recovery.

The way that the LMI makes a numeric determination is taking statistics of single-family housing permits, employment,

and home prices calculated for the entire country and specifically 337

local markets. Single-family home permits rose from .48 to .49, new

home prices increased from 1.38 to 1.40, and employment rose from .96 to

.97. The really good news is that approximately 35% of the 337 markets

have a score that exactly equaled 1 or is greater than 1.

The way that the LMI makes a numeric determination is taking statistics of single-family housing permits, employment,

and home prices calculated for the entire country and specifically 337

local markets. Single-family home permits rose from .48 to .49, new

home prices increased from 1.38 to 1.40, and employment rose from .96 to

.97. The really good news is that approximately 35% of the 337 markets

have a score that exactly equaled 1 or is greater than 1.

The number of markets which increased overall in single-family home permits in a year-over-year comparison rose by almost 65%. Employment numbers increased 71%. Three hundred twenty-four markets out of the 337 are now showing new home pricing that is considered normal according to the last data recorded in a normal real estate market in 2006.

For communities located in Louisiana, almost all counties accounted for were located in the top 20% of housing rankings. Approximately 4 areas were in the top 60% – 80% rankings relative to normal housing numbers for new home permits, employment and new home pricing. Louisiana overall experienced a far softer impact of the slowdown in housing market numbers of the Recession than other states in the United States. Baton Rouge consistently ranks in the top 10 cities in the United States with the best recovery numbers to date.

Click Here for the Source of the Information.

How is the LMI Calculated?

The way that the LMI makes a numeric determination is taking statistics of single-family housing permits, employment,

and home prices calculated for the entire country and specifically 337

local markets. Single-family home permits rose from .48 to .49, new

home prices increased from 1.38 to 1.40, and employment rose from .96 to

.97. The really good news is that approximately 35% of the 337 markets

have a score that exactly equaled 1 or is greater than 1.

The way that the LMI makes a numeric determination is taking statistics of single-family housing permits, employment,

and home prices calculated for the entire country and specifically 337

local markets. Single-family home permits rose from .48 to .49, new

home prices increased from 1.38 to 1.40, and employment rose from .96 to

.97. The really good news is that approximately 35% of the 337 markets

have a score that exactly equaled 1 or is greater than 1.The number of markets which increased overall in single-family home permits in a year-over-year comparison rose by almost 65%. Employment numbers increased 71%. Three hundred twenty-four markets out of the 337 are now showing new home pricing that is considered normal according to the last data recorded in a normal real estate market in 2006.

For communities located in Louisiana, almost all counties accounted for were located in the top 20% of housing rankings. Approximately 4 areas were in the top 60% – 80% rankings relative to normal housing numbers for new home permits, employment and new home pricing. Louisiana overall experienced a far softer impact of the slowdown in housing market numbers of the Recession than other states in the United States. Baton Rouge consistently ranks in the top 10 cities in the United States with the best recovery numbers to date.

Click Here for the Source of the Information.